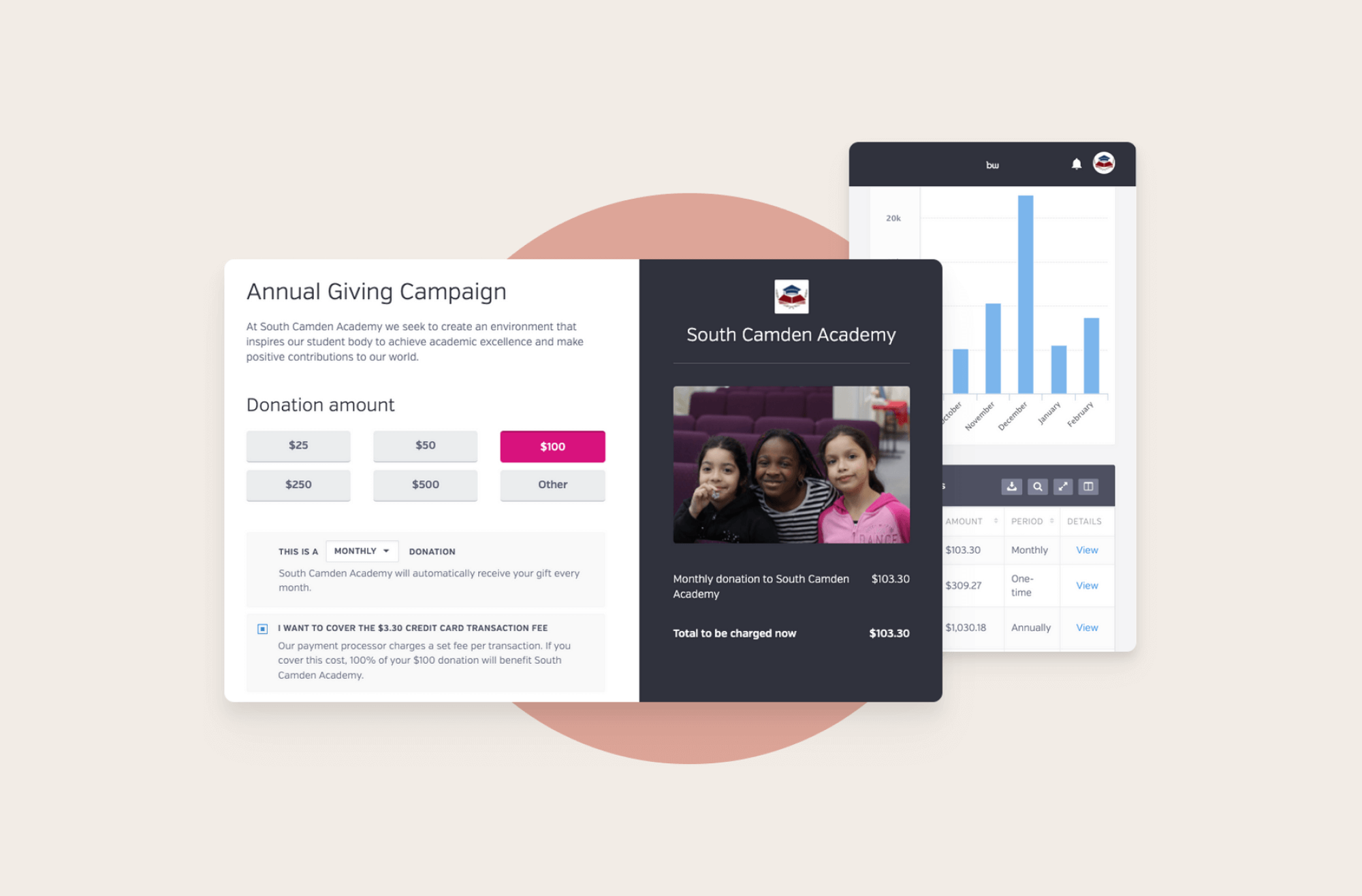

Simplify donations with customizable default donation amounts

Streamline your processes and keep online and offline donations in one place

Engage with your donors with automatic updates

Give your donors the ability to donate once, monthly, or annually

Want to build an effective fundraising campaign?

Our team is here to give you more details and guides on how to grow your fundraiser.

What Is a Donation Acknowledgement Letter?

By Whit Hunter

Giving to others is a powerful way to make a difference, whether it's through donating money or items. It's a gesture that speaks volumes about compassion and the desire to help. But after the donation is made, there's an important step that follows. This step revolves around a special communication called a Donation Acknowledgment Letter.

In this article, we'll talk about what these letters are, why they're sent, and what should be included in them. Let's get started on understanding this key part of donating.

Understanding Donation Acknowledgment Letter

A donation acknowledgment letter or a thank you note is a thoughtful way to express gratitude to your supporters. It serves as a confirmation that their donation was received and is greatly appreciated.

These letters can be in the form of an email or a paper note and go beyond just confirming receipt—they convey heartfelt thanks and the importance of the donor's contribution.

Additionally, it's worth noting that sending these letters is not just about good manners, as it's also a requirement by the IRS for certain donations.

Why Should Your Nonprofit Send Donor Acknowledgment Letters?

Sending a donor acknowledgment letter is a critical part of building and maintaining a strong relationship with those who support your cause.

Here are the main reasons why nonprofits should prioritize sending these letters:

1. Legal Requirement

For donations of $250 or more, the IRS requires a written acknowledgment for the donor to claim a tax deduction. This requirement makes sending the letter not just a nice gesture but a legal necessity.

2. Builds Trust and Appreciation

By acknowledging a donation promptly, a nonprofit shows that it values and respects its donors. Research indicates that donors who are thanked within 48 hours are four times more likely to give again.

3. Confirmation of Receipt

It gives donors peace of mind knowing that their contribution has been received. It also provides essential details like the amount of the donation and the date it was received.

4. Encourages Future Giving

Acknowledgment letters can inspire donors to continue supporting the nonprofit by showing how donations are used and their impact.

Besides, personalized letters can make donors feel more connected to your cause, as about 71% of donors feel more engaged when they receive content that feels personalized to them.

5. Improved Donor Relations

These letters are a touchpoint for ongoing communication with donors. They can be used to share stories about the nonprofit's work, upcoming events, or other ways donors can get involved, further engaging them with the cause.

For all these reasons, sending donor acknowledgment letters is an essential practice for any nonprofit aiming to sustain and grow its donor base.

Want to raise more Donations? Try BetterWorld’s Donation Tool for FREE!

When Should Nonprofits Send Donor Acknowledgment Letters?

When nonprofits should send donation acknowledgment letters is guided both by IRS requirements and best practices for donor engagement.

According to the IRS, written acknowledgment is required for all donations of $250 or more. For donations below this amount, it's not a legal requirement unless the donor received goods or services in return for a contribution over $75.

Although there's no formal IRS deadline for sending out donation acknowledgments, a best practice for year-end acknowledgments is to send them before January 31 of the year following the donation. This approach helps donors by giving them plenty of time to prepare their tax returns.

Ideally, acknowledgment letters should be sent within 48 hours of receiving a donation.

Acknowledging every donation, regardless of size, with a prompt "thank you" letter is highly recommended to build goodwill and encourage future donations.

What Happens If You Don’t Send a Donor Acknowledgment Letter or Receipt?

If your organization doesn't send a donor acknowledgement letter or receipt, you won't face a direct penalty. However, not sending these letters means you're not treating your donors the way they should be treated.

When someone gives to your cause, sending them a thank you note right away is crucial. It shows them you appreciate their support.

Also, for donors to get the full tax benefits from their donation, they need a receipt/letter. So, it's really important to send one as soon as possible.

Key Components of a Donor Acknowledgment Letter

To write a concise yet comprehensive donor acknowledgment letter, make sure to include these essential elements:

- Organization's Full Name: Clearly state the name of your organization.

- Donor's Name: Use the donor's name as it was given for the donation.

- Date of Donation: Mention the exact date the donation was made.

- Donation Details: Include a description of the donation. If it's a cash donation, specify the amount. For non-cash donations, describe the item but not its value.

- Acknowledgment of Receipt: Confirm that no goods or services were provided in exchange for the donation, or if they were, detail what was provided and its estimated value.

- Tax-Exempt Status: Declare your organization's tax-exempt status and provide your Employer Identification Number (EIN).

- Contact Information: Offer a way for the donor to reach out if they have questions or need further information.

- Thank You Message: Don’t forget to express gratitude for the donor's contribution.

Example Of a Donor Acknowledgment Letter

[Your Organization's Letterhead or Email Header]

Date

Donor's Name

Donor's Address

Dear [Donor's Name],

On behalf of [Your Organization's Name], I want to extend our heartfelt thanks for your generous donation of $[Amount] received on [Date]. Your support is crucial to our mission of [Briefly Describe Mission], and it is donors like you who make our work possible.

As a 501(c)(3) organization (EIN: [Your EIN]), your donation is tax-deductible to the fullest extent permitted by law. [If applicable: No goods or services were provided in exchange for this contribution.]

Your contribution will be directed toward [Brief Description of How Donation Will Be Used, showing the impact of their donation]. [Optionally, include a specific story or outcome that shows the impact of donations like theirs.]

We are committed to keeping you updated on how your support is making a difference. [Optional: Include information about upcoming events, newsletters, or other ways the donor can stay engaged with your organization.]

Once again, thank you for your generosity and support. Your donation is making a difference in [mention the cause, community, or group benefitted]. We look forward to a continued relationship and are here to answer any questions you may have about your impact.

Warm regards,

[Your Signature]

[Your Name]

[Your Title]

[Your Contact Information]

Remember, while this template serves as a starting point, your acknowledgment letters should reflect your organization's unique voice and mission. Adjust the language to match your style and the specific impact your organization has, making each letter as personal and impactful as possible.

Bottom Line

A donation acknowledgment letter is more than just a thank you. It's a personal touch that shows your appreciation and respect for every gift. Whether big or small, every donation helps make a difference.

Remember, by taking the time to say thank you in a heartfelt way, you're letting your donors know how much their support means. It's all about making them feel valued and part of your mission's success.

Join 100,000+ amazing nonprofits, organizations, and fundraisers on BetterWorld

Let our FREE fundraising tools help you raise more funds with less effort