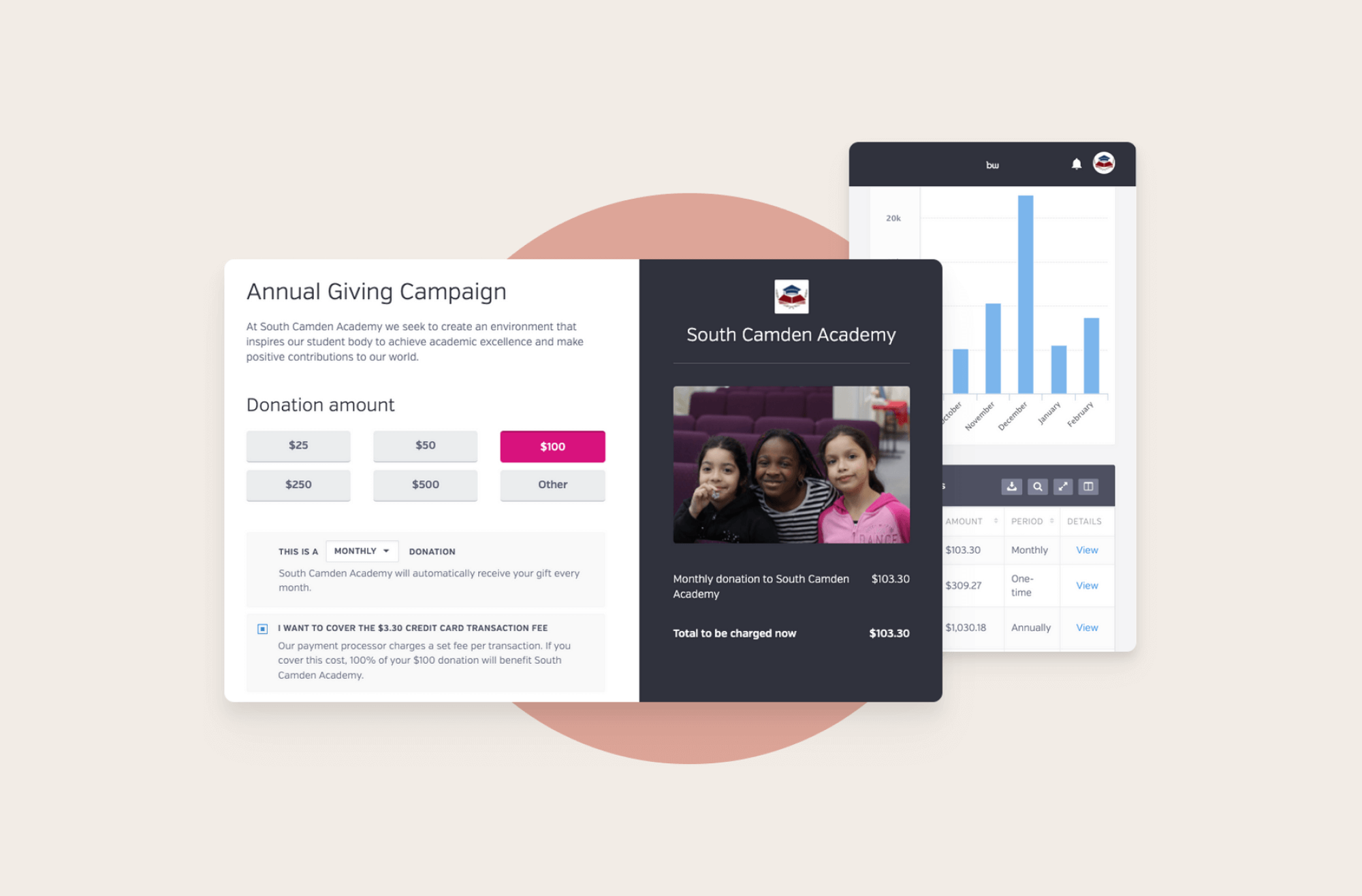

Simplify donations with customizable default donation amounts

Streamline your processes and keep online and offline donations in one place

Engage with your donors with automatic updates

Give your donors the ability to donate once, monthly, or annually

Pledge vs Donation - What Are The Key Differences

By Whit Hunter

Many of us want to help causes we care about, and we often come across the terms "pledge" and "donation." They might sound similar, but they are used differently when it comes to giving support. It's important to understand what sets them apart to make informed decisions about our contributions.

This blog will explore the key differences between a pledge and a donation and help you choose the best way to support your favorite nonprofit organizations.

What is a Pledge?

A pledge is a promise to give money or help to an organization in the future. When someone makes a pledge, they are saying they will donate later.

A pledge can be very helpful for nonprofits that need to plan their budgets and activities, knowing that funds will come in the future.

Types of Pledges

There are two main types of pledges: conditional and unconditional.

1. Conditional Pledges

These pledges depend on certain conditions being met before the pledge is fulfilled. For example, someone might pledge $1,000 to a charity if it can raise $10,000 from other people.

2. Unconditional Pledges

These are promises to give money or help without any conditions. The person pledges an amount and is expected to provide it no matter what happens.

When and Why People Choose to Pledge?

People choose to pledge for many reasons:

- They want to help but might not have the funds ready right away.

- They believe in the cause and want to ensure the organization can plan its future.

- They want to encourage others to donate by committing a significant amount themselves.

Organizations often encourage pledges during fundraising events to help reach their financial goals over a longer period.

Benefits and Challenges of Pledges

Benefits:

- Pledges keep donors involved with the cause for a longer time, which can build stronger relationships.

- Organizations can plan their activities better when they know how much money they will receive in the future.

Challenges:

- Sometimes, people might not fulfill their pledges due to changing circumstances or financial difficulties. It can leave organizations in a tough spot if they were counting on that money.

What is a Donation?

A donation is when someone gives money, goods, or services to help a charity or cause without expecting anything in return. Unlike a pledge, which is a promise to give later, a donation is handed over at the moment, allowing the recipient to use it right away.

Types of Donations

Here are the two most common types of donation.

1. Monetary Donations

These are cash gifts given to organizations. People can send money through checks, credit card payments, or online transfers.

2. In-Kind Donations

These include any non-cash items like clothes, food, equipment, or services that are given to help a cause.

Want to raise more Donations? Try BetterWorld’s Donation Tool for FREE!

Common Reasons for Donating

People donate for many reasons:

- To support a cause they feel strongly about.

- To help people in need or to contribute to a community.

- For personal satisfaction or to honor someone else.

- Sometimes for tax benefits, as many donations are tax-deductible.

Benefits and Challenges of Donations

Benefits:

- Donations are used right away, which is crucial for urgent needs.

- Donating is simple, and people can choose how and when they give.

Challenges:

- Unlike pledges, which can create long-term commitment, donations are often one-time, so maintaining long-term engagement can be challenging.

- Organizations might depend on continuous donations, which can be uncertain and fluctuate.

Key Differences Between a Pledge and a Donation

Here is a comprehensive table listing the key differences between a pledge and a donation:

Definition

- Pledge: A promise to give money or resources in the future.

- Donation: An immediate transfer of money, goods, or services.

Timing of Support

- Pledge: Given at a later date, often in the future.

- Donation: Provided immediately.

Conditions

- Pledge: Can be conditional or unconditional.

- Donation: Typically unconditional.

Engagement

- Pledge: Encourages ongoing engagement and future commitment.

- Donation: Usually a one-time act of support.

Financial Planning

- Pledge: Helps organizations plan for future funding needs.

- Donation: Helps with immediate financial needs.

Risk

- Pledge: Risk of unfulfilled promises if circumstances change.

- Donation: Less risk, as benefits are immediate.

Types

- Pledge: Often monetary, pledged over time.

- Donation: Can be monetary, in-kind, or recurring.

Purpose

- Pledge: Often used in large fundraising efforts or campaigns.

- Donation: Used for immediate impact or specific needs.

Tax Implications

- Pledge: Tax benefits apply when the pledged amount is paid.

- Donation: Immediate tax benefits if applicable.

Impact on Tax Deductions and Legal Considerations

Both pledges and donations have distinct characteristics that affect how they are treated legally and for tax purposes.

Tax Deductions

Donation

When you donate money or goods to a qualified nonprofit, you can usually deduct the value of your donation from your taxable income that same year. For example, donating $100 can reduce your taxable income by $100, potentially lowering your tax bill.

To get this tax benefit, you need to itemize your deductions on your tax return and have a receipt from the nonprofit.

Pledge

With a pledge, you promise to give money in the future. You can only claim a tax deduction in the year you actually pay the pledged amount.

For example, if you pledge $1000 in January 2023 but pay it in January 2024, you can only claim the deduction on your 2024 tax return.

It's important to keep good records of when you made the pledge and when you fulfilled it.

Legal Considerations

Donation

Donations are pretty simple. Once you give the money or goods, the transaction is complete.

There are no ongoing legal obligations after a donation is made other than retaining records for tax purposes.

Pledge

Pledges create a more complex legal dynamic. They represent a commitment to give in the future, which can be legally binding.

If a pledge is not fulfilled, the organization may have the legal right to pursue fulfillment of the pledged amount. Therefore, documentation and clear communication about the pledge terms is crucial.

Why Both are Important for Nonprofits?

Both pledges and donations play important roles in supporting nonprofit organizations.

How Pledge and Donation Support Nonprofit Sustainability

Because they are often paid in installments, pledges can provide a reliable stream of funding over time. It allows organizations to anticipate funds and allocate resources accordingly, ensuring sustainability.

Donations are important for meeting the day-to-day operational needs of nonprofits. They allow for flexibility and the ability to respond quickly to urgent needs or opportunities as they arise. Donations can be used right away, which is essential for covering ongoing expenses like staff salaries, utility bills, and emergency aid.

Strategic Use of Both in Fundraising Campaigns

Nonprofits can maximize their fundraising efforts by strategically using both pledges and donations.

For instance, during a capital campaign or a large project, pledges can be used to build momentum and secure long-term funding, while direct donations can be encouraged for immediate needs and smaller goals.

A mixed approach allows organizations to appeal to different types of donors.

Considerations for Donors

Before deciding between making a pledge or donating to support nonprofit organizations, here are a few things to consider.

How To Decide Which To Choose?

Choosing between a pledge and a donation often comes down to your current financial situation and your desire to see immediate or long-term impacts.

If you're ready to help right away and have the funds on hand, a donation is a direct way to make an impact. It allows you to contribute to an organization's needs promptly.

On the other hand, if you're planning for the future and prefer to spread your support over time, making a pledge might be more suitable. A pledge lets you commit a larger amount in smaller, more manageable payments. It might help with your budget while providing ongoing support to the organization.

How to Approach Making a Contribution?

Before contributing, it's important to learn about the organization's mission, effectiveness, and how it manages its finances.

Make sure your money goes to a reputable group and is used as intended. Understanding the specific impacts of donations versus pledges can also guide your decision on how much and how often to give.

For those considering a pledge, getting clear terms in writing is crucial. Both you and the organization should fully understand the commitment. If you're donating, keeping records is essential for tax purposes and for your own tracking.

Every Contribution Counts in Supporting Nonprofit Goals

Whether it's choosing to make a pledge or providing a donation, the most important thing is your support's positive impact on nonprofits and their valuable work.

Each type of contribution plays a key role in helping these organizations achieve their goals. Remember, every bit helps, and the choice to help is a powerful one.

Join 105,000+ amazing nonprofits, organizations, and fundraisers on BetterWorld

Let our FREE fundraising tools help you raise more funds with less effort